Duration Calculator Zero Coupon Bond

Bond duration calculator macaulay duration and modified macaulay duration determine how much money you would accumulate by investing a given amount of money at a fixed annual rate of return at recurring intervals.

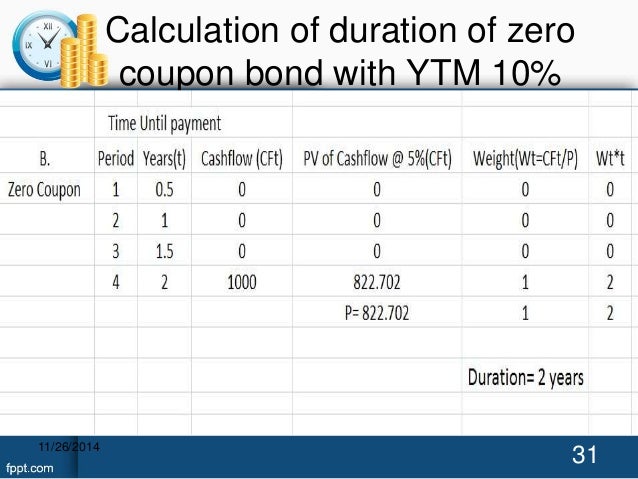

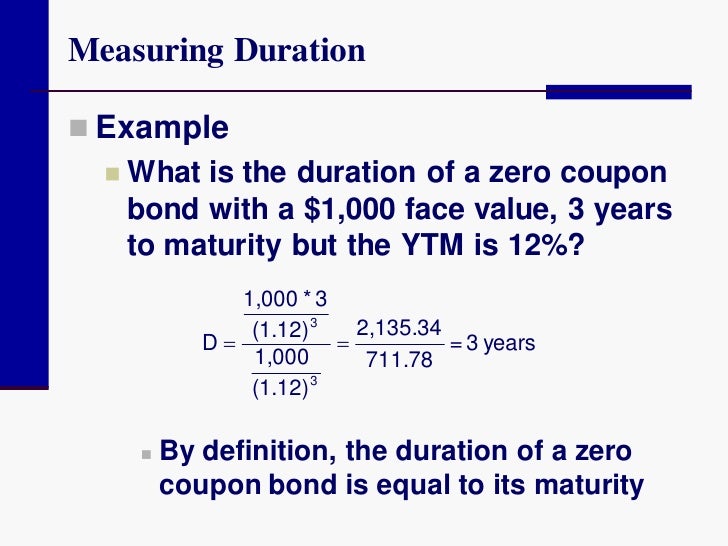

Duration calculator zero coupon bond. The macaulay duration of a zero coupon bond is equal to the time to maturity of the bond. The zero coupon bond calculator is used to calculate the zero coupon bond value. Let s take the following bond as an example. The bond is currently valued at 925 the price at which it could be purchased today.

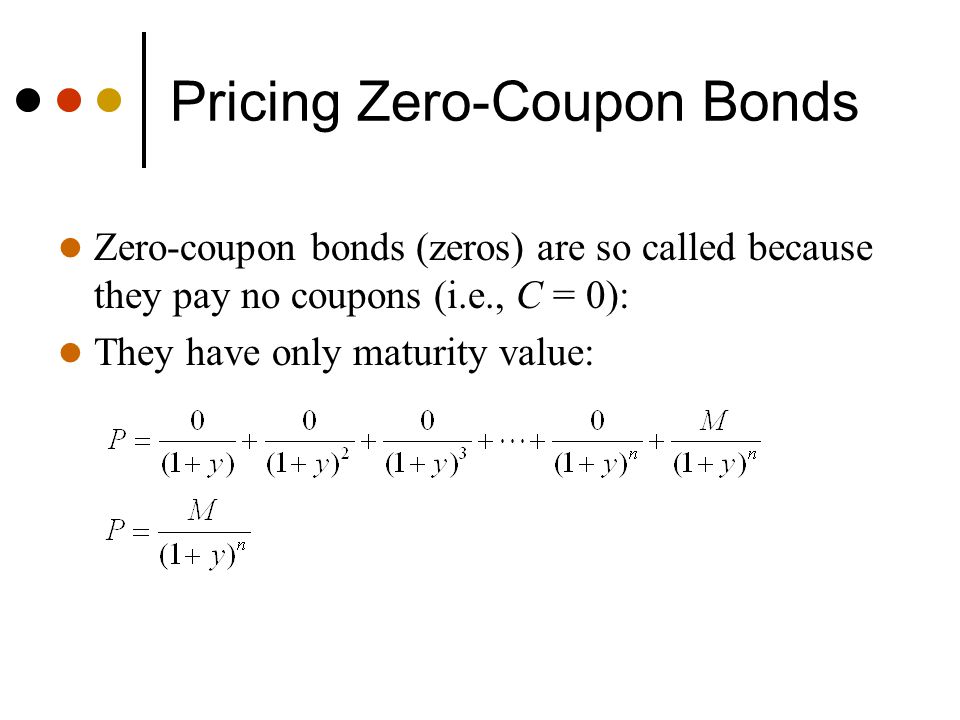

The formula for calculating the yield to maturity on a zero coupon bond is. Value face value 1 yield 2 years to maturity 2 related calculators. Consider a 1 000 zero coupon bond that has two years until maturity. The formula would look as follows.

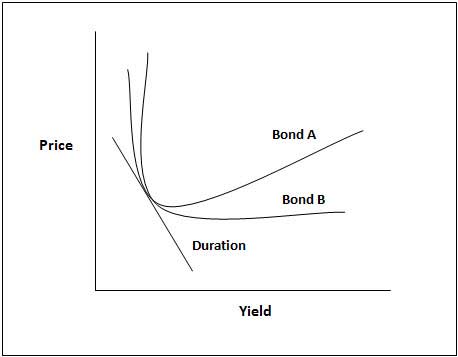

463 19 and its face value i e. And zero coupon long duration bonds are more sensitive to rate shifts than bonds which regularly pay interest. Typically the yield curve is upward sloping with longer duration bonds offering a higher return to compensate for the added risk. Thus the present value of zero coupon bond with a yield to maturity of 8 and maturing in 10 years is 463 19.

A zero coupon bond is a bond which doesn t pay periodic payments instead having only a face value value at maturity and a present value current value. Zero coupon bond definition a zero coupon bond is a bond bought at a price lower than its face value with the face value repaid at the time of maturity. Looking at the formula 100 would be f 6 would be r and t would be 5 years. The macaulay duration can be viewed as the economic balance point of a group of cash flows.

A 5 year zero coupon bond is issued with a face value of 100 and a rate of 6. The calculator which assumes semi annual compounding uses the following formula to compute the value of a zero coupon bond. After 5 years the bond could then be redeemed for the 100 face value. After solving the equation the original price or value would be 74 73.

1000 is the amount of compound interest that will be earned over the 10 year life of the bond. Enter the coupon yield to maturity maturity and par in order to calculate the coupon bond s macaulay duration modified macaulay duration and convexity. Bond calculator macaulay duration modified macaulay duration convexity coupon bond calculate bond macaulay duration modified macaulay duration convexity.

/bond-market-15b215dd1fb741ff82f940a4e7c1d66a.jpg)